Vishesh Raisinghani

·4 min read

Financial problems often stem from low income or high debt. However, some people simply suffer from bad planning.

Kansas-based Cole says he and his wife make a combined income of $112,000 but are struggling to get by. He says he forgot some bills, and an unexpected medical emergency for his son put his account into overdraft.

Don’t miss

Anything can happen in 2024. Try these 5 easy money hacks to help you make and save thousands of dollars in the new year (they will only take seconds)

Robert Kiyosaki warns 401(k)s and IRAs will be 'toast' after the 'biggest crash in history' — protect yourself now with these shockproof assets

Commercial real estate has topped the stock market for over 25 years — but only the elite had access. Now you can super-spike your wealth even if you're just an everyday investor

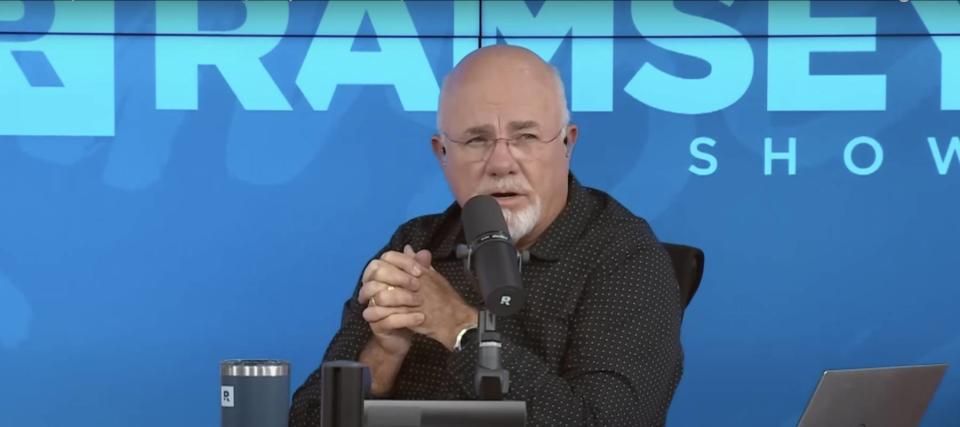

“After that I’m just trying to play catch-up,” he said on an episode of The Ramsey Show. “It’s just been one thing after another.”

However, after digging into his finances, Dave Ramsey became convinced Cole’s problem wasn't debt but bad planning.

“You’re completely chaotic and disorganized to the point that you’re out of control,” he told Cole. “That’s the only explanation because there’s nothing glaring in these numbers.”

Here’s why the finance guru believes a simple budget is all the couple needs to change their situation.

Safe on paper

Cole and his wife have borrowed money in a few ways, but none of their debts are extreme.

The hospital payment plan is a $222 monthly payment. Their outstanding credit card balances total $14,000. They owe $10,700 in auto loans on two cars, one of which was due to be sold. Cole’s wife has $30,000 in student loan debt, while their house has a mortgage of $102,000.

None of these amounts is above average. As of the third quarter of 2023, the average loan amount for a new vehicle is $40,184, while a used car has an average loan of $27,167, according to Experian.

The average mortgage balance per household was $241,815 in the second quarter, while the average federal student loan balance is $37,718, according to the most recent figures from the Education Data Initiative.

Meanwhile, Cole and his wife earn a solid income, with Ramsey pointing out “$112,000 is no slouch in Wichita, Kansas, dude.”

On paper, the couple’s debt should be easily manageable. However, Cole claimed they’re falling behind on payments at a rate that going into overdraft seemed “inevitable at this point.”

“You guys must be some of the most disorganized, completely chaotic people that I've run into in a while,” Ramsey said. Fortunately, he saw an easy path out of this mess.

Read more: Don't miss out: Jeff Bezos reveals the secret to prime real estate profits — say goodbye to landlord headaches

Four strong walls

Ramsey encouraged Cole to prioritize spending on essential items first. The couple need to spend on food, utilities, housing, cars and fuel before they consider anything else. It’s a budgeting strategy Ramsey calls the “four walls.”

“You take care of the four walls of your house,” he said. “The necessities of life: food, shelter, clothing, transportation, utilities, gas in the car, and everything else can wait.”

Based on these priorities, creating a robust budget shouldn’t take longer than an hour and a half, Ramsey estimated.

“You’re going to turn around so fast!” he said.

The simple takeaway from Cole’s predicament is that budgeting is a powerful tool that’s too often overlooked. A survey by Credit.com found that 27% of Americans don’t think a budget is necessary, while 24% believe they won’t stick to a budget even if they had one.

Fundamentally, a budget requires people to actually be aware of what they make, what they spend, and have a plan to reconcile the two. For something as important as a family’s finances, playing fast and loose can land you in trouble for no good reason.

What to read next

A Pennsylvania trio bought a $100K abandoned school and turned it into a 31-unit apartment — but here's a much simpler way to earn real estate riches without a mountain of red tape

Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here’s how you can save yourself as much as $820 annually in minutes (it's 100% free)

Even your credit card interest is accumulating interest as you read this — stop this 'bad compounding' today by paying off your card fast and saving thousands in interest. Here's how

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.